Some say our nation has seen better days, but America still has three great industries: medicine, propaganda, and inflation.

For her last two days of life, it seems, my late wife was rolling like a sheik in Cannes. In the grip of a ferocious Fentanyl jag, she ordered 24/7 bottle service for the full staff of two major regional hospitals. Presumably there’s coke and strippers on the tab, too—under the proper CPT codes. Insurance will probably mostly cover it.

Still, if it’s been a shitty year—at least I’m in the propaganda industry. I am indebted to my readers, and especially my subscribers, for making it a bearable one. My family and I are well. My deepest thanks to all who sent condolences, or even just thought them. Join us or die:

Now, let’s talk about our third great industry, inflation. Actually, it’s probably the first. America, or what is left of her, is—a currency, a university, and a hospital.

The inflation economy is all patterns of labor caused by or dependent on inflation. In a healthy country, an inflation economy would not exist. It would not need to exist.

In our unhealthy country, an inflation industry does need to exist. Just turning off our inflation machine would be like just turning off the USSR—if not worse. (Actually, it turns out that it is not the jobs, not even the stuff, but the people that matter.)

Any effective drug is too strong. There is no regular process of Mellonist liquidation that could (as in 1920) deflate the financial system while preserving civic order. Special restructuring, practical only as part of a broader political transition, would be needed.

This actually helps us discuss inflation—with the equanimity of the cancer patient who knows his only option is philosophy. We are not here to criticize the inflation economy. Were I on the Federal Reserve Board—seated as cardinal, at the high altar of America’s high temple of inflation—I should concur with my fellow hierophants. There can be no reasonable dissent from inflation. There is no reasonable alternative.

Modern Inflation Theory

But we still need to explain inflation. Maybe this explanation would go farther if I gave it a pompous, catchy name, like “Modern Inflation Theory” (MIT).

“Inflation is always and everywhere a monetary phenomenon.” This is MIT’s elevator pitch. Milton Friedman said it 50 years ago and it is still true.

Crash course in inflation: inflation is two things, A and B. A and B are both bad. B is obviously bad. A is subtly bad. A causes B. A also causes other things. In theory, other things can cause B. In practice, B almost always involves A.

B, the symptom, is difficult to measure. A, the cause, is impossible to measure—and also impossible to mitigate, at least not without annoying its beneficiaries. B can be mitigated by many non-monetary government policies and even organic processes.

20th-century “macroeconomic” central-planners define “inflation” as AB or even just B, measure B, and so automatically take undeserved credit for these exogenous or organic mitigations. Friedman’s point is that the only important phenomenon is A. First, A causes other bad things than B. Second, you can’t mitigate A, only conceal it.

A is monetary dilution. B is consumer appreciation. Monetary dilution causes consumer price appreciation. Appreciation is a symptom; dilution is the disease. Diagnosing and treating symptoms, let alone merely painting over them, is not the science of medicine but the witch-doctor’s art.

“Inflation” is the syndrome AB—a deceptive malapropism. The main use of this label is to divert attention from the simple cause A to the complex, difficult syndrome AB. The label “inflation” is a semantic minefield and no one should use it both sincerely and ambiguously. I’ll just say “inflation (A)” and “inflation (B).”

The point of Modern Inflation Theory (presented below), is that although we cannot measure inflation (A), or monetary dilution, directly, another proxy C is a better metric (though still imperfect and indirect). This proxy, inflation (C), is wealth appreciation.

Deconstructing “inflation”

Tthe need for linguistic subterfuge becomes clear if we recode A and B in demotic political language. B, consumer appreciation, means: everything keeps getting more expensive. A, monetary dilution, means: rich people keep stealing money from everyone. (A demotic, imprecise synonym for “monetary dilution” is “counterfeiting.”)

So “inflation” means: everything keeps getting more expensive, because rich people keep stealing money from everyone. One can see how a person might want to say that more… subtly. This inflation (A) is indeed, as Friedman put it, “a monetary phenomenon.”

The MIT (Modern Inflation Theory) hypothesis is that we can see how much the rich keep stealing, by looking at how much richer they keep getting. Obviously MIT is a radical theory and might even find a warm welcome with the Industrial Workers of the World, but we literary economists have to go where the logic takes us.

While it is true that this number, inflation (C), wealth appreciation, contains factors which cannot be attributed to monetary dilution, most “investment” neither adds valuable information to a neutral prediction market, nor finances the production of tangible capital.

Most of the world’s “investment” is just a sail in the wind of inflation (A). The wind, of course, has storms; the most sophisticated ships sail the fastest yet capsize the least; this is why big hedge funds, like Renaissance or Harvard, earn 20%—or in a bad year, 5%—and your checking account earns 0%. (Maybe Renaissance should start a college.)

Again, almost all of this system serves no direct productive purpose. Its only purpose is to invisibly make the rich richer, and just as invisibly tax the poor. The world’s poor, of course—the dollar is a global financial system.

Unfortunately, this purpose is essential to the normal functioning of the US economy. As we’ll see, the dollar inflation machine produces a third to half of US GDP. Any plan for just turning it off is just a silly plan.

Mitigating consumer price appreciation

With these definitions of “inflation” A, B and C, we can see why mitigating inflation (B), consumer price inflation, by making goods and services better and/or cheaper, counteracts monetary dilution, a mitigation does not reverse monetary dilution.

It obscures monetary dilution. If dilution is theft—thieves always appreciate privacy.

Without any monetary dilution, any mitigation becomes a boon. The inflation machine confiscates this boon, selling it to pay for what it steals. Since you never had that boon, you hardly notice losing it. Inflation has the lightest fingers in the world. Let’s talk about some of these mitigations.

Of course, technical progress—an entirely non-monetary phenomenon—is the main organic mitigation. A natural effect of technical progress is to lower production cost. This would naturally lower consumer prices. If prices can remain constant instead, progress creates a profit. This profit can then be stolen.

For example: according to the Bureau of Labor Statistics, one of these 1930s agencies (readers may be surprised to learn that these “macroeconomic” statistics, like GDP and inflation (B), are less than a century old), car prices have not changed since either of us learned to drive. This makes perfect sense. If you remember wrong, you are just wrong.

It is true that, in mere dollars, a new ‘20s Mustang costs two or three times as much as a new ‘80s Mustang. You overlook a crucial fact: it is two or three times as sweet a car. Therefore, your car per dollar has not changed. So there has been no inflation (B).

This is literally the logic of said Bureau of Labor Statistics. The purpose of statistics is to measure and manage root causes of patterns of economic action. While it is true that, by 21st-century standards, that ‘80s pony corners like a pregnant hippo, it seems most unclear what effect all the world’s Fahrvergnügen could cause on economic action.

Yet these numbers are used to price zillions of dollars of financial instruments. Raw, unadjusted, accurate data from actual markets are called “nominal” until injected with this aggregate Fahrvergnügen, at which point they become “real.”

And of course, had there been no inflation (A), you could still get a cherry-red, loaded 2021 Mustang for 12 grand. That difference? It was stolen.

Another way to mitigate production cost is to lower labor costs. You like strawberries. You don’t want to pick strawberries. Nor does anyone you know. If strawberries had to be picked by you and people like you, consumer strawberry prices would be very high.

However, if farmers could employ prisoners, serfs, immigrants, robots, children, etc, to pick berries, their costs would drop—creating a profit, which could be stolen as above. Increasing the effective inequality and heterogeneity of an economy is generally a way to lower consumer prices. As aristocrats, you and I should have no problem with this. BRB learning to love our new latifundia economy and its sprawling, immaculate lawns.

Another strawberry, dear Flavius Liquidius? Your crypto is still up on the year, I hope… how lovely it is to bank huge inflation gainz, and with them buy moar cheap berries, pick’t by Gaulish scab-labor prisoners of war. Caesar’s latest victories have really cut our landscape bills—you have no idea what it takes to keep a villa bucolic these days..

For if any industry is the inflation industry, it’s the crypto industry. What is monetary dilution? Is it really stealing? How does it work? How big is it, actually? How do they get away with it? And how is it good for crypto? Let’s use bitcoin itself as a thought-experiment to explore the nature of America’s neo-Roman imperial inflation economy.

The simplest financial system

One way to show the dysfunctional nature of the early 21st-century dollar system is to design the perfect financial system, then gradually degrade it by a series of abusive, shocking accounting violations—until it turns into the system we know and love.

As a currency, we’ll start with bitcoin, except perfect (from the user’s point of view). No new bitcoins are created. Transactions are both free and instant. (Let’s not worry about how this works—it’s a thought-experiment—let’s hear nothing about blocksize etc.)

On top of this are two kinds of security coin: stocks and bonds. A stock owns some part of a productive asset, and the same part of its profit stream. A bond is a promise of future fixed payment. (The predicted dividend stream of a stock can be seen as a kind of super-junior bond.) A pool of risk-free bonds which are just timelocked bitcoins sets a risk-free interest rate across a series of standard terms, so that a bond can be priced as a function of the risk-free yield curve and the probability of default.

These standard contracts are all we need for a simple but functional financial system. Savers save in bond baskets, like CDs, chosen by expected savings maturity and risk tolerance. Speculators, like poker players, profit if and only if they are better than the average speculator. No ordinary fish should swim in such a pool—or needs to.

In a stable financial environment, only unpredicted macroscopic changes in the structure of reality can cause any macroscopic change in financial indicators. “The market” as a whole does not systematically go up or down—unless macroscopic events affect every company in the market. There is no way to profit from “the market,” except by adding information to it. There is no “passive investing.”

And there is no inflation (A). Crop failures, etc, can still cause nonlocal changes in price level, interest rates, etc. Systematic human mispredictions are never impossible. But in an evenly rotating economy, there is no business cycle, nor any other pattern of endogenous financial instability. (If you don’t believe me, educate yourself.) Like the Wuhan Institute of Virology, the Fed is causing the problem it was designed to solve.

So how do we solve it? In real life, there’s only one problem with this Austrian bitcoin nirvana. There’s no clear way to get there from here—not, at least, without blowing everything up. You might think you want that! But… you don’t actually want that.

In our thought-experiment, there’s a second problem. Satoshi kept a backdoor. Satoshi still has god-mode access to this whole financial system. He wouldn’t want to turn it back into the dollar. We’ll make him do it anyway, though.

Normalized accounting

Our first step away from Mises’ evenly-rotating economy will be to break normalized accounting. Normalized accounting is a principle of finance that everyone knows is true, and everyone applies everywhere except in one case: money itself.

In normalized accounting, an account balance is not a number of units, but a fraction of total units. Obviously, in a currency with a fixed supply, normalized and nominal accounting (ie, normal accounting) are equivalent.

But when the money supply is not fixed—they diverge. When normalized and nominal accounting disagree, which one is right? Logic tells us that when units have no value except as fungible parts of some whole, they must be valued as fractions of that whole. Money must be valued as a fraction of the money supply outstanding.

Anyone who owns stocks and isn’t wet behind the ears knows that a stock split doesn’t affect your portfolio’s value, even if it gives you twice as many shares. When Satoshi uses his backdoor to turn every bitcoin into two bitcoins—leaving 42 million coins, a more auspicious number—he makes no one richer or poorer. So long as all contracts in bitcoins are also rewritten, this redenomination of the currency is portfolio-neutral.

So normalized accounting is right. But without computers, it’s hard. In both stocks and currencies—less controversially in the former—creating new units is common.

Suppose a company has 1 million shares outstanding. The CEO issues 100,000 new shares and trades them for a purple-glitter bowling ball. In normalized accounting, he has just taxed each of his shareholders by relieving them of 1/10 of their shares.

Of course, since the company’s assets have increased by one (1) bowling ball (purple, glitter), perhaps each remaining share is worth 1/10 more. If he bought not a bowling ball, but his last upstart competitor, that might be so—which is why issuing new shares is legal and normal.

This same operation could be papered in a normalized-accounting system—but this would require editing everyone’s portfolio, which is nontrivial even on a blockchain. On physical paper, it could never have worked.

And since, 20th-century finance is 1900s paper finance ported onto 1970s batch-processing computers, creating new shares actually does make a lot of sense—at least, in the historical sense. While normalized accounting is right, nominal accounting is useful. But we always want to know what the latter means in terms of the former.

Decline and fall of the bitcoin standard

Satoshi, with his evil backdoor, shall now begin to operate. (Let us assume that the world is somehow completely locked in to the bitcoin standard, and cannot ragequit to some tacky little altcoin over this unforgivable violation of everyone’s monetary trust.)

Satoshi’s first step is to mint a million bitcoins—diluting the supply by 5%—and pay them to himself. This is pure inflation (A): monetary dilution.

Obviously, this “monetary phenomenon” is outrageous. Isn’t bank robbery always and everywhere a monetary phenomenon? Counterfeiting, too? But it raises a fascinating theoretical question.

What if Satoshi never spends his coins? Is Satoshi’s hoard still part of the money supply? Since the only effect on you of someone else’s money is if it either buys something from you, or bids against you to buy something, how can this frozen hoard have any concrete effect on the world?

The answer is that Satoshi’s stash is the extreme corner case of a Cantillon effect—which is a mighty fancy label for the obvious observation that, since new money is never evenly distributed across an economy, its impact on price levels is also uneven.

In this corner case, the new money is distributed into a hole in the ground. Generally, though, wealth does tend to spread itself around—even when given to the wealthiest. No one ever said trickle-down economics doesn’t work. But it’s called trickle-down for a reason: most of it stays where it is. In Satoshi’s special case, this is just all of it.

In any case, it is this phenomenon of printing new money and giving it to the rich—not terribly different from taxing the working poor to pay the idle rich, the general pattern of the premodern economy whether we like it or not—that we are seeking to analyze.

If a billionaire counterfeits a billion dollars, and does not spend it, he has still stolen a billion dollars. Even if he does spend it, it will take a long time for every last trickle from that river of cash to raise the price level of some year’s Mustang.

He has still stolen a billion dollars. And detecting this by measuring not just the price, but the price per Fahrvergnügen of Mustangs—is a rather obtuse way to observe a crime, amounting nearly to complicity.

Virtual counterfeiting

Monetary dilution, counterfeiting, inflation (A), whatever we call it, is—theft.

Except if done by and for the government. Sometimes it must be—even Frederick the Great, peace be upon him, once had to debase his coin when the Seven Years’ War took a bad turn. Official dilution is theft, in the same sense that taxation is theft: it isn’t. Hopefully it is at least funding the conquest of Silesia. Or… Afghanistan?

Unofficial dilution is… theft. Even if it is legal. (And it is very legal.) Taxation is not theft—but even taxation should not be conducted as if it was theft. Taxation has least a chance of being fair and transparent. An “inflation tax” is neither.

The only advantage of inflation (A), whether its receiver is the public or private sector, is its opacity—which is only of use to thieves. Since our Evil Satoshi is a thief, he will try to remain as opaque as possible.

Evil Satoshi, with his backdoor, doesn’t want anyone to know much he’s stealing. But when he mints a million coins and sends them to himself, his evil minions, etc, this dirty deed is right there on the blockchain. How can he hide this? Some kind of zk-SNARK? “Zero knowledge. Means you don’t got to know, and I don’t got to tell you.”

No. Satoshi can hide his larceny by using his powers to virtually dilute Bitcoin, with a power that cannot be measured by measuring his actions. Here’s how this virtual counterfeiting works.

Satoshi wants to use his backdoor, but not use it. Therefore, instead of using it to create 21 million bitcoins, he uses the same tools as any schmo to create 21 million… SatoshiCoins… a pure and unmitigated shitcoin, without any redeeming technical merit.

Then he announces that SatoshiCoins are pegged 1:1 to bitcoin. Anyone who wants to trade one for a bitcoin can trade it to him—and get back a real coin, fresh-coiled from Satoshi’s backdoor.

Satoshi does not have to defend this peg—except once, to prove it. Therefore, the amount of purchasing power he can create is not bounded by the number of coins he has to mint.

An issuer of infinite money can immeasurably create unlimited purchasing power. This virtual monetary dilution is why we can’t measure the money supply—in the macroeconomic sense—by the amount of money created.

Loans and loan guarantees

And what is the effect on aggregate purchasing power if Satoshi mints new coins not as gifts (to himself or others), but as loans?

Satoshi lends the world 1 million bitcoins for a year. This does not really change the world’s demand for money, because while it increases the world’s gross purchasing power for a year, the world also has to spend that year scraping together 1 million bitcoins to pay back Satoshi. Yet suppose he rolls over the loan? Suppose he rolls it over indefinitely? Since we cannot quantify the willingness of any lender to renew or forgive the loan, we cannot quantify the impact of lending on purchasing power.

Perhaps the most elegant way for Satoshi to create purchasing power is not even to issue loans, but rather loan guarantees. A loan guarantee is an invisible loan; when A guarantees B’s loan to C, B has really loaned money to A, who has loaned it to C.

In a classical bank deposit, A is the government, B is you, and C is the bank. You lend your money to the government and the government lends money to the bank, which uses it to buy a bond. So present dollars have been spent to buy future dollars (the bond); but those present dollars remain in circulation.

Since your bank account is actually a zero-term loan to the government, which can print dollars, this money substitute is perfect: it has no risk or maturity. Therefore it increases the money supply.

This is a systemic dilution engine—at least so long as it never runs in reverse, and repays all this aggregate debt. (A “central bank digital currency” cuts out this ancient nonsense—bank accounts are no longer key to the 21st-century inflation machine.)

Satoshi appears to be stabilizing markets by neutralizing systemic risks. Satoshi is subsidizing markets by giving away free options, and inflating them by lending bitcoins against bitcoin bonds.

Since the supply of bitcoins defines the demand for bitcoin bonds, this circularity can create an arbitrary quantity of bitcoin equivalents, without creating any new bitcoins at all—only having the power to do so.

This design can easily create a bitcoin securities market whose aggregate valuation is 20x the number of bitcoins in the world. Imagine a world on the gold standard, whose productive sector promised to yield a profit stream worth 20x the gold in the world.

What? This is clearly too much—but how much is too much? We can ask this question with a thought-experiment in which, at the start, all money is held by individuals, and all capital by the government. Then the capital is auctioned. Then the proceeds of the auction are distributed equally to all individuals—which may change capital prices. But then the system is stable, and it has no particular reason to destabilize itself.

We are stepping into, or at least toward, the horrid world of mathematical economics. But this iterated game cannot produce a securities valuation that exceeds the money supply—and there seems no reason for its result not to be a stable equilibrium.

Mises called securities a “money substitute.” A bitcoin substitute should not expand the bitcoin supply, for two reasons. One: it is an imperfect coin, due to its maturity, risk or both—and any token that isn’t just a timelocked bitcoin has nonzero risk. Two: an imperfect coin may be valuable, but it is both nonfungible and unspendable.

Without magic options and invisible loans, lending does not create purchasing power. Suppose I lend you a bitcoin for a year. For that year, I cannot spend the coin; you can. All I have is the promise you gave me. I can sell the promise; but then the buyer has become the lender, and relinquished the same purchasing power. The promise is an imperfect coin; it has value, but not spendability.

Satoshi’s intervention perfects these imperfect coins, and turns them into perfect and spendable bitcoin substitutes. When Satoshi lends me a bitcoin, secured by my loan to you, we both can spend today. When Satoshi guarantees an agent who guarantees my loan to you, he may never even need to use his backdoor—though he certainly has to prove both that he has it, and that it will be in his interest to use it.

A security is the general case of debt; this inflation machine is a machine for infinite debt. Few appreciate the fact that stock outstanding is a liability on the balance sheet, just like debt: when its stock goes up, a company is expected to kick out more money. The only difference is that its earnings are a prediction, not a promise.

Therefore, as the securities market keeps going up, the productive sector keeps going deeper into the red. Of course, the consumer sector keeps going deeper into the black—which keeps spending going up, increasing corporate revenues.

This engine definitely needs to not seize up or go into reverse. And indeed, Satoshi is there to make sure it does not. Is he even evil? Or is he the benefactor of the economy?

Money creation cannot be measured

It is often important to demonstrate the obvious. The above thought-experiment has demonstrated that a unilateral money issuer can invisibly and immeasurably increase the price, in money, of assets yielding money. Well, duh.

In plain English: the Fed can make the stock market go up, and the housing market, and even the crypto market, without literally creating dollars. So there is no way to measure monetary dilution, the amount of dollar purchasing power the Fed creates.

And in the global dollar economy we have today, the value of global dollar assets is about 100x the number of global dollars. This was not done by “printing dollars.” It was done by giving away free options. And such options cannot even be priced.

There are actually three kinds of options: American, European, and Third World. An American option contract can be exercised before expiration. A European option can’t be. A Third World option has no contract and can’t be exercised—unless it can.

The Fed’s informal, off-the-books guarantee of FDIC is of this last species. There are formulas for valuing American and European options. Not even God can price a Third World option, like the notorious “Greenspan put.” This subsidy can never be measured.

Since the Fed can create purchasing power by inflating asset prices, not creating dollars, there is no useful definition of money as distinct from other financial assets. And there is no useful way to measure the money supply per se.

Purchasing power can be measured

But—this is actually fine. We can just acknowledge this reality—and measure all assets.

Your effect as a buyer on consumer markets is a function of your purchasing power. Your effect is not a function of your portfolio structure. Some major capital assets, such as houses, are slightly difficult to liquidate; but generally speaking, your patterns of spending will depend on your personal net worth. We can call all the dollars in this net worth portfolio dollars.

Therefore, in the financial system we have rather than the financial system we should have, there is a simple way to measure monetary dilution: catch it at the next bend in the causal stream. Roughly, monetary dilution equals growth in personal net worth. This is the only useful and effective measurement of inflation (A).

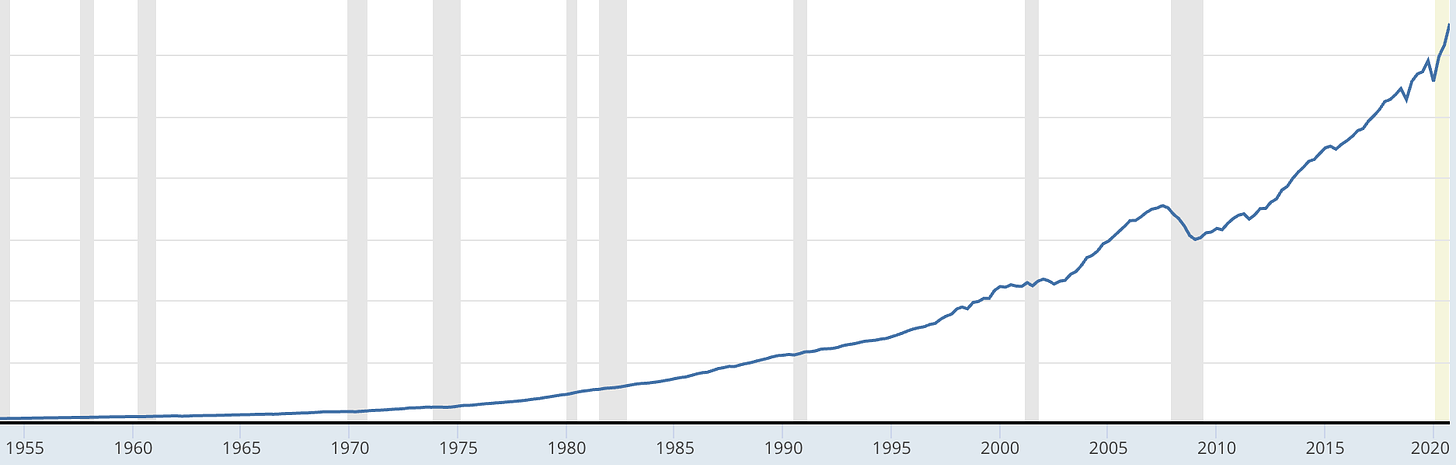

Even better, the Fed itself has a pretty good handle on this data series:

This is a graph of how much money the government has secretly given away to the rich. Since 1950, American personal net worth in portfolio dollars has gone up by about 100x. (Arguably, personal gross worth might be a better metric, considering the American attitude toward carrying debt—add this series, removing the GDP fudge.)

According to normalized accounting, if every portfolio dollar gave the exact same return—maybe paper banknotes could even increase in face value—and contracts were likewise indexed, this inflation would be neutral and have no economic effect. The economy would be evenly-rotating, just weirdly-denominated.

But of course, newly-minted portfolio dollars are hardly distributed evenly; the best returns go to the richest, most sophisticated investors, while a mere checking account pays nothing at all. In general, the oldest, slowest-moving dollars in the biggest hoards are the most fecund; cash on the street, or near the street, is universally sterile. It’s not even in a basic index fund, let alone levered up like Harvard on acid.

This is why it is accurate, if incendiary, to describe monetary dilution as the rich stealing from the poor. Effectively, the high-velocity dollars of the poor are taxed to subsidize the low-velocity dollars of the rich.

“Investing” your low-velocity dollars means turning your savings into a kind of inflation antenna, which is dangerous because it is also an antenna for systemic risk. The biggest pools of money have high-leverage antennas and big fire extinguishers. (And sometimes they still catch fire—but the poor burn better, too.)

Even before Covid, keeping the American rich (obviously, if you’re not rich, you don’t have a “personal net worth”), in the style to which they are accustomed, was costing the Fed somewhere around $10 trillion a year. In 2019, for instance, PNW rose from $105 trillion to $118 trillion. The gray vertical bars are “recessions,” in which our inflation engine somehow throws a rod and peters out—or even goes into reverse. 2020, of course, was a banner year for inflation (A), and might even print $20 trillion.

Killing Satoshi

US GDP is, like, $20 trillion a year. So, even in a normal year, the inflation industry is half of the US economy. That’s why we can’t just give up counterfeiting. We have made ourselves into a nation of counterfeiters.

Here is why “the market” needs to keep going up. People get pretty used to “the market” going up. If “the market” has a bad year and is flat, they don’t have as much money as they expected. So they’re going to spend less.

They’re not going to spend $10 trillion less. They might easily spend $2 trillion less. Consumer spending is basically GDP is basically corporate revenue. A revenue hit like this will wipe the floor with “the market”—and so on.

So flat is not an option. While up can keep going up, flat means down. Down means very down. This is bad, but actually it gets worse.

We may think Evil Satoshi is evil—but what’s really evil is what will happen if we just kill him off, or even shut his backdoor. All the Third World options he’s written just evaporate. They were all underwritten by the backdoor.

Now they’re worthless—and there are a lot of people whose portfolio bitcoins, made of imperfect promises plus Satoshi’s perfecting guarantees, are suddenly imperfect. This is the mother of all bank runs—and it must end with an enormous drop in the demand for debt. Most of which will be worthless anyway, because no one can pay it off.

Ron Paul famously wanted to “end the Fed.” Here is what happens if you “end the Fed.”

Picture 130 trillion portfolio dollars, or 400 trillion globally, all trying to find their way back into 6 trillion actual dollars. Picture a game of musical chairs, in which 394 of the chairs suddenly vanish. It is wrong to call this kind of hyperdeflationary event a recession or a depression—it is not even a zombie apocalypse—even the zombies would just starve—if you like to eat, kid, the Fed is your father, your mother, your country and your God. So have some respect, eh? We’re not getting out of this that easily.

The inflationist’s complaints

The inflation addict’s immediate objection is that his index-fund gains, or even worse his crypto gainz, are somehow genuine or organic. This is not just the government printing money and giving it to the rich. No! This is capitalism! We Pluto-Americans are being remunerated as we deserve for our prudent investments in America’s future!

First: the assets in this net worth are the capital assets of America—its farms, factories, houses and offices. Certain remodeling has been done; certain processes have been improved; certain land has been fertilized; certain persons have even been imported. To say that in some genuine and organic sense, the quality or quantity of any or all of these assets has increased by 100x since 1950, is to embrace a preposterous historical delusion. Some might even suggest that America as a whole has gone downhill…

Second: while the technical quality of American products has certainly improved, quality alone has no direct financial or economic effect. Nothing that does not matter should be measured. Nothing matters which cannot cause anything.

Since it does not matter, except for pure Fahrvergnügen, how fast your pony can take a hairpin turn, secular quality improvements cannot explain secular price increases—either in consumer or asset prices. Money is a store of value, not a yardstick of pleasure; the hedonic treadmill is not a monetary phenomenon.

We can easily imagine an evenly-rotating economy in which, while quality increased, price did not. Indeed, since durability is one element of quality, and tradeoffs between quality and price are common, economic activity if anything naturally tends to shrink with improvements in technology. If the new Mustangs are twice as durable, Mustang sales drop in half—a veritable recession. Technical progress cannot excuse inflation, which is always and everywhere a monetary phenomenon.

Third: while the justice of robbing the ragged poor to glut the rich with dainty delights can be debated, especially since it seems to be a human historical universal, the effects of the phenomenon are independent of either its justice or its cause.

However organic, monetary dilution or inflation (A) is pure “UBI for the rich.” Again, most civilized societies have managed to justify this economic structure to themselves, so there’s no reason ours can’t. All we can ask is to see clearly what it is.

If Americans, instead of “investing” our savings in our great national casino as we are required to do, instead of holding “portfolios,” all held mere digital dollars at the Fed (or CDs if they wanted to defer their savings), and all rented from the government, and every year just got massive beast-mode checks for moar money, as a function of course on how much money they already had, the inflation economy would work in exactly the same way as it does now. Except that anyone could see how heinous it is.

Look at 2008, on the curve above, to see what happens when the inflation machine breaks. In 2008, “personal net worth” has to write massive checks. The gray bars are recessions—as measured by GDP, ie, consumer spending plus hedonic fudge. When the machine goes into reverse and steals from the rich, spending drops; businesses lose money; and the poors get laid off. We observe that the little guy gets the shaft, always.

And when the inflation machine is working, who loses? Ultimately, this is not an economic question, but an aesthetic question. The whole world, not America, is on the dollar standard; the whole world experiences monetary dilution; the world’s rich live by printing money, then spending it on goods and services made by the world’s poor.

This, in the 21st century, is “capitalism.” This is the inflation economy. It’s really not so different from the late Roman Empire. That lasted a long time, too.

And if you think the world’s economy should work some other way—you have to explain how, instead, it should work. And then you have to figure out to get it there. Hardly anyone has even started on this job, which is almost certainly impossible.

Great piece, glad to have you back. Wishing the best for you and your family.

Not to be a dick, but didn't you tell us last week we can't simulate the properties of

complex systems? Yet now you pimp v. Mises, whose whole thing is making claims *a priori* from his axioms? For all it's flaws, central banking is an empirical art, where intuitive hustlers (Greenspan, Powell) out perform theoreticians (Bernanke, Yellen).

MV=PT=Nominal GDP

When Nominal GDP drops below trend, in big, diversified economies, you get a recession.

When NGDP holds around a trend line, for decades, like in Australia, you get economic stability. This is empirically how things have worked for decades, in many countries. Greece and Italy, on the tight-money of the Deutsche Mark, I mean Euro, hadn't seen NGDP growth for a decade prior to the China Virus, and those economies still haven't recovered. Still waiting to clear all that "malinvestment".

Did you know that neither Poland, Israel, nor Australia had recessions in 2008-2009?

Isn't that remarkable? Have a look at their NGDP charts. They all have their own central banks.

Every country on earth uses a fiat currency managed either by a central bank, or pegged to another fiat currency. No one uses commodity money, or even a voluntarily frozen monetary base. You'd think Russia, Iran or some other more or less sovereign country would adopt a gold standard, and reap the theoretical benefits. None of them do, because they've learned the lesson of the 19th century. When you move from a Malthusian, farming economy, to an industrial and commercial economy, with financial markets, less and less barter, more and more posted prices, and more activity mediated through markets, price stickiness becomes 'a thing'. Rather than have all the prices in the economy chase the fluctuating value of commodity money, you have a flexible, fiat monetary system so that the value of money can be adjusted, in a manner expected to stabilize the economy. In a manner expected to produce stable NGDP growth.

Prior to ~1800, home production dominated. You could avoid the money economy for months, years even. After 1800, it becomes harder, and then impossible to avoid the money economy. We shouldn't be surprised that such a change necessitates a modification of the monetary system.

If you don't like 2.5% inflation, don't keep all your wealth in a demand account, and maybe campaign against the capital gains tax. If you want to improve the position of workers (increase the labor share of GDP), regulate immigration, and restore womenfolk to home production. If you don't want stocks going up so much in 2021, campaign for a lower trend rate of NGDP. Prior to the China Virus, we were on a 4% trend line, now, under China Joe Chernenko, we're on a 5% trend line. What's 1% of 20 trillion, compounding every year, indefinitely? It's got to be priced into the income streams of equities.